Life Care Planning is a holistic, elder-centered approach to elder law that helps families respond to challenges created by the long-term illness or disability of an elderly loved one before, during, and after the onset of declining health. Life Care Planning helps families receive the assistance and care needed to maintain the desired quality of life for as long as possible. Families get access to a wider variety of options for care as well as knowledgeable guidance from a team of compassionate advisers who help them make the best choices about every aspect of their loved one’s well-being.

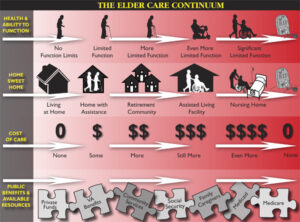

Life Care Planning uses a model called the Elder Care Continuum to help families understand the natural progression of aging and its impact on a loved one’s health, mobility, housing, and financial resources. Your initial meeting with Mayhone Elder Law will focus on your loved one’s position on each resource line of the Elder Care Continuum and identify gaps in care. When your customized Life Care Plan is developed, it defines, organizes, prioritizes, and mobilizes every aspect of your loved one’s care, to allow him or her to maintain the quality of life that he or she desires.

The Elder Care Continuum

A Life Care Plan includes the following:

- Integration of Legal, Financial, and Personal Care needs.

- Legal Care, estate planning including wills, trusts, powers of attorney and advanced directives; Medicaid planning; guardianship; and protection of the elder’s right to safe and effective care for which he or she is entitled.

- Care Coordination, which includes locating in-home help and services, coordinating home health care and long-term care, family education and decision-making support.

- Patient Advocacy and crisis intervention to help you get the highest quality care for your loved one in every long-term care setting.

We want to help your family through the maze of the aging process.